What Is Tax Planning?

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. A plan that minimizes how much you pay in taxes is referred to as tax efficiency. Tax planning should be essential to an individual investor's financial plan. Reduction of tax liability and maximizing the ability to contribute to retirement plans are crucial for success.

Key Takeaways

- Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible.

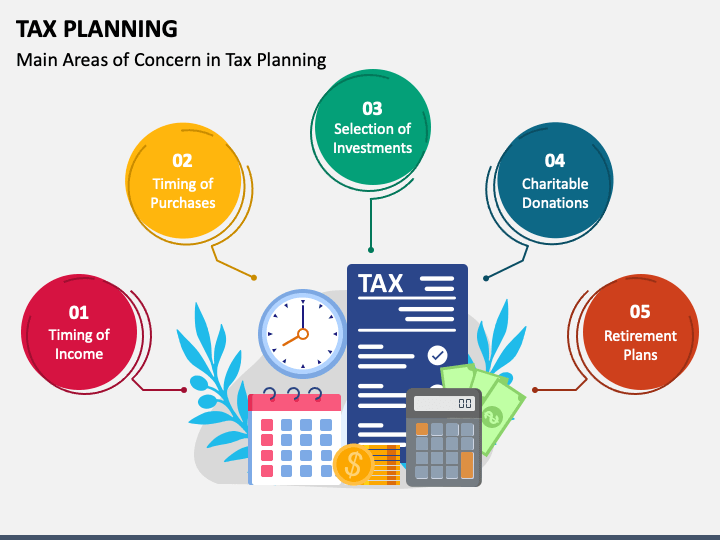

- Considerations of tax planning include the timing of income, size, purchase timing, and expenditure planning.

- Tax planning strategies can include saving for retirement in an IRA or engaging in tax gain-loss harvesting.

Objectives of Tax Planning

- To minimise your tax liability

- To ensure tax efficiency

- To facilitate legal tax savings

- To increase your disposable income

- To encourage voluntary compliance with tax laws

- To enable prudent investment planning

- To forecast tax obligations

- To optimise retirement planning

- To reduce tax-related litigation

Types of Tax Planning

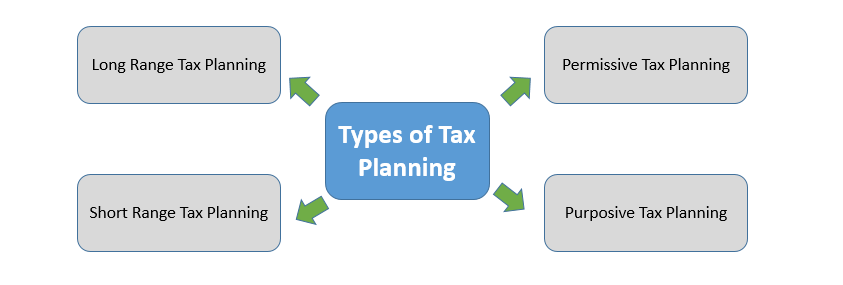

1. Short-term Tax Planning:

Short-term tax planning focuses on minimising tax liability for the current financial year. It involves analysing your income, expenses, and investments to ensure efficient tax management within a shorter time frame.

2. Long-term Tax Planning:

Long-term tax planning involves comprehensive financial planning for the future, considering multiple financial goals and priorities. It aims to achieve tax efficiency over an extended period by strategically managing investments, assets, and income.

3. Permissive Tax Planning:

Permissive tax planning involves utilising the exemptions, deductions, and credits provided by the tax laws to legally minimise the tax liability. Taxpayers can take advantage of specific provisions to maximise their savings.

4. Purposive Tax Planning:

Purposive tax planning aligns financial decisions with specific tax-saving objectives. It involves strategically structuring income, expenses, and investments to achieve desired financial outcomes rather than selecting as many tax benefits as possible.

The Importance of Tax Planning

Legal Reduction of Tax Liability

- By utilising various tax laws and deductions in your tax planning exercise, you can legally minimise the amount of tax you have to pay.

Investment Guidance

- Tax planning helps you make smarter investment decisions and guides you towards tax-efficient investments that also help you achieve your financial goals.

Compliance with Tax Laws

- Tax planning also ensures that you adhere to the provisions of the Income Tax Act. This, in turn, reduces the risk of legal issues and penalties for non-compliance.

Better Financial Understanding

- Tax planning provides greater clarity about your financial obligations and allows for more effective budgeting and financial planning.

Business Profitability

- Businesses can make use of tax planning to significantly improve their bottom line and turn potential losses into profits through smart tax strategies.

Peace of Mind and Financial Security

- Tax planning offers a sense of security about your future financial needs and obligations and helps you plan for your regular expenses as well as major milestones like retirement.

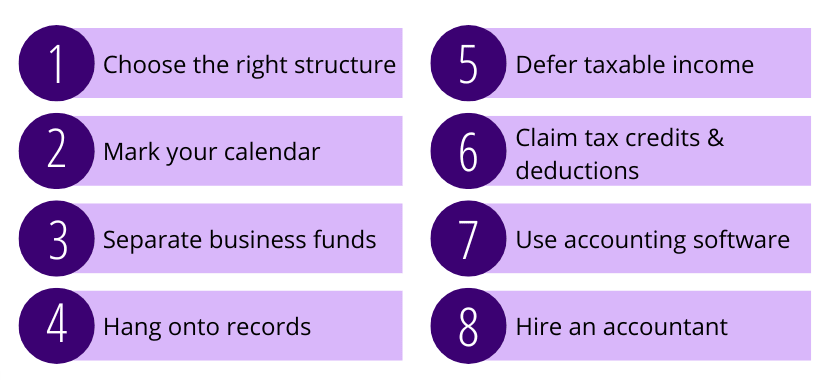

Tax Planning Strategies

Tax Planning vs. Tax Loss Harvesting

The concept of tax planning is often misunderstood as tax loss harvesting. However, the two strategies have quite a few differences. Specifically, the scope of tax planning is broader and encompasses tax loss harvesting, which involves using capital losses to offset capital gains, thus reducing the overall tax liability.

Let’s explore how the two practices are different.

Particulars |

| Tax Loss Harvesting | |

Meaning | A strategy for rearranging your financial affairs to minimise tax liabilities within legal boundaries | A technique that involves selling investments at a loss to offset tax on capital gains | |

Objective |

To reduce overall tax burden, maximise deductions and plan for future tax liabilities

| Specifically to reduce taxes on capital gains by offsetting losses against gains | |

Scope | Broader as it encompasses income, investments, deductions and tax credits | Narrower as it focuses primarily on investment portfolios and capital gains | |

Time Frame | Can be short-term or long-term, depending on your goals and financial situation | Generally short-term to medium-term as it aligns with the maximum duration over which capital losses can be carried forward | |

Approach | Proactive and planned, often involving long-term strategies | Reactive to market movements and changes in investment portfolio values | |

Applicability |

| Primarily relevant for investors with capital gains and losses in their portfolios | |

Benefits |

| Primarily helps lower the capital gains tax | |

Complexity | Can be complex as it requires an understanding of various tax laws and financial planning principles | Less complex than overall tax planning but requires an understanding of investment strategies and capital gains/losses |

FAQS – FREQUENTLY ASKED QUESTIONS

Tax planning is essential for everyone earning an income, including individuals, businesses, and companies. It's crucial for those looking to optimise their financial profile by minimising their tax liabilities within legal frameworks.

The right time to start tax planning is at the beginning of the financial year. Early planning helps you make informed decisions, take advantage of all available deductions and exemptions, and avoid rushed decisions at the last minute.

Some of the most basic tax planning strategies include reducing your overall income, such as by contributing to retirement plans, making tax deductions, and taking advantage of tax credits.