What is a Fixed Deposit?

A fixed deposit is a type of savings account offered by banks and financial institutions that provides a fixed rate of interest for a specific period of time.

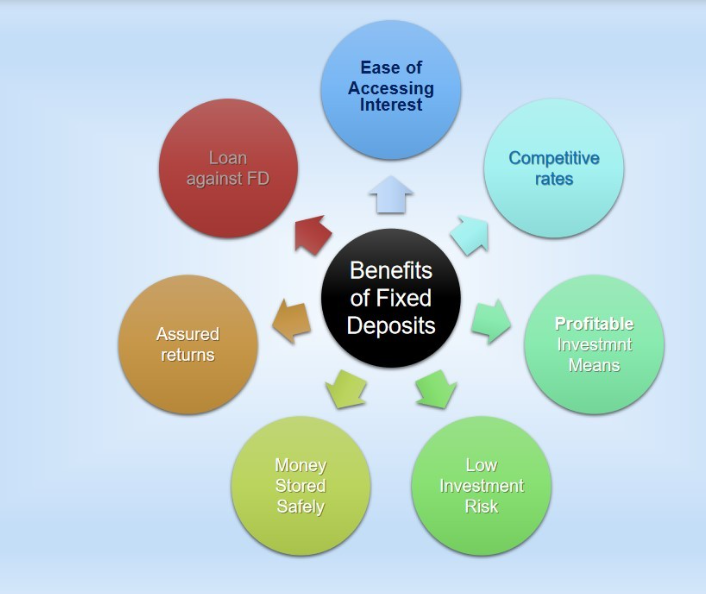

Benefits of Fixed Deposits:

- High returns compared to regular savings accounts

- Low risk and stable investment

- Flexibility in deposit amount and tenure

- Liquidity and easy withdrawal

- Tax benefits

Types of Fixed Deposits:

- Traditional FD: Fixed interest rate and tenure

- Flexible FD: Allows for changes in interest rate or tenure

- Tax-Saver FD: Tax benefits for investments up to a certain limit

- Senior Citizen FD: Higher interest rates for senior citizens

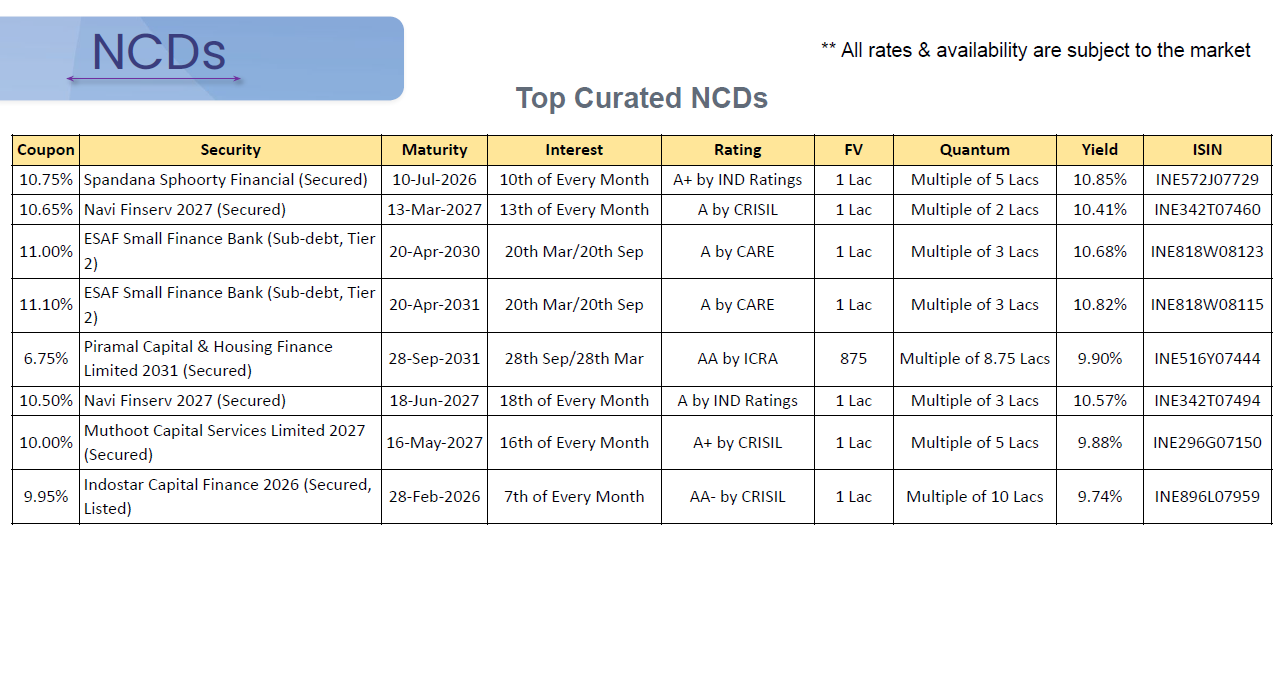

"What are NCDs?"

NCDs are debt securities issued by companies to raise funds from investors. They offer a fixed rate of interest and a return of principal amount on maturity. Unlike convertible debentures, NCDs cannot be converted into equity shares.

"Benefits of Investing in NCDs"

- Regular income through interest payments

- Relatively low risk compared to equity investments

- Fixed returns, reducing market volatility risk

- Opportunity to diversify your investment portfolio

"Why Invest in NCDs with Us?"

- Expert guidance and support

- Access to a wide range of NCD issuers

- Competitive interest rates and terms

- Convenient investment process

What is a Bond?

A bond is a debt investment where an investor loans money to an entity (corporate or government) for a fixed period of time, receiving regular interest payments and return of principal.

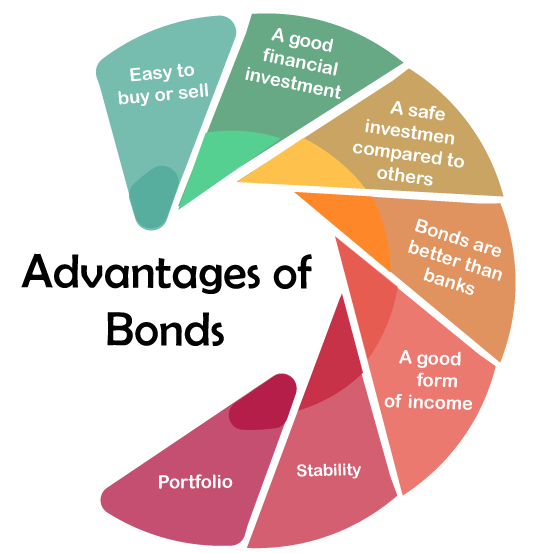

Benefits of Bonds:

- Regular income through interest payments

- Relatively low risk compared to stocks

- Liquidity and easy transferability

- Diversification of investment portfolio

- Tax benefits

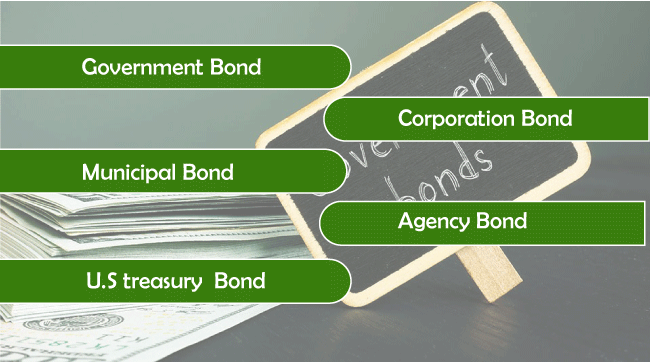

Types of Bonds:

- Government Bonds (e.g. U.S. Treasury bonds)

- Corporate Bonds

- Municipal Bonds

- High-Yield Bonds

- International Bonds

Key Considerations:

- Credit risk and default risk

- Interest rate risk

- Liquidity risk

- Tax implications

Conclusion

Fixed Deposits and Bonds are two popular investment options that offer a range of benefits, including stable returns, low risk, and liquidity. By understanding the features, benefits, and considerations of FDs and Bonds, investors can make informed decisions to achieve their financial goals.

Key Takeaways:

- FDs offer high returns, low risk, and flexibility

- Bonds provide regular income, relatively low risk, and diversification benefits

- Both FDs and Bonds offer tax benefits and liquidity

- It's essential to consider credit risk, interest rate risk, and liquidity risk when investing in Bonds

Investment Strategy:

- Diversify your portfolio with a mix of FDs and Bonds

- Consider your risk tolerance, financial goals, and time horizon

- Regularly review and rebalance your investments

Contact us to open a Fixed Deposit account or invest in Bonds.

Consult with our financial experts to create a personalized investment plan

Take the first step towards achieving your financial goals with confidence.