Why Plan for Retirement?

You retire from work, not life. You may have a new set of dreams for your post-retirement life. At the same time, you may also want to maintain your day-to-day lifestyle without worrying about expenses.

By planning in advance, you can define the path to achieve these life goals without any financial dependence.

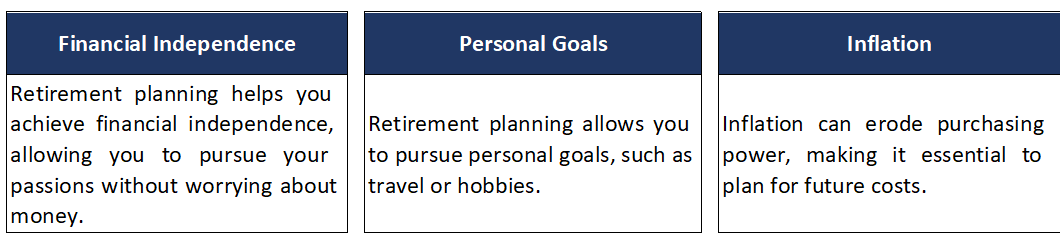

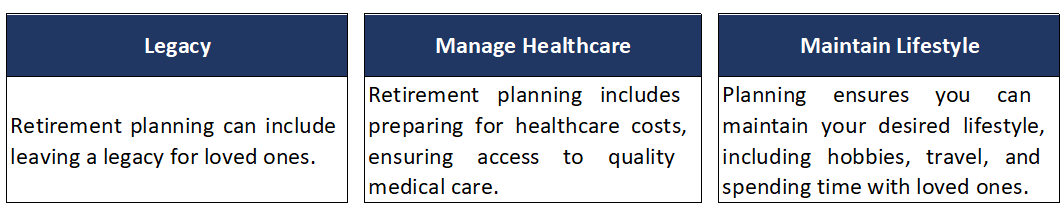

Here is how retirement planning can help you:

How Much Do You Need to Retire?

The amount you need to retire will depend on your post-retirement goals. You may have goals such as starting a venture, pursuing your hobbies, travelling and so on. You may also want to maintain your current lifestyle post retirement. The amount you would need must account for all your retirement needs. You must consider factors such as any income sources as well as inflation. These factors help you determine a suitable figure for your retirement needs.

How Retirement Planning Works

Retirement plan is your preparation for a good life after you're done working to pay the bills, or at least done working a full-time job. But it's not all about money.

The non-financial aspects include lifestyle choices such as how you want to spend your time in retirement and where you'll live. A holistic approach to retirement planning considers all these areas.

The goals for your retirement plan will change in focus over time:

- Early in a person’s working life, your contribution to retirement savings may be modest. The reward is 40-plus years of investment growth.

- During the middle of your career, when your income may be at its peak, you might set specific income or asset targets and take steps toward achieving them.

![]()

Once you reach retirement age, you go from accumulating assets to what planners call the distribution phase. You’re no longer paying into your retirement account(s). Instead, you start collecting the rewards of decades of savings.

Advantages of retirement plans

Below are the advantages of a retirement plan:

Returns for life

Retirement plans such as annuity plans provide you returns for life. You may choose to invest regularly or as a lump sum and stay financially independent for your entire life.

Regular income after retirement

A retirement plan helps you create a regular flow of income after retirement. Retirement plans offer a fixed income which substitutes for your pre-retirement salary. You can use this money to cover your daily expenses, such as groceries, fuel, electricity, and more. You can also meet your post-retirement goals, such as traveling, pursuing a hobby, starting a new venture, and more.

Tax2 benefits

A retirement plan provides you with tax2 benefits. You can claim a deduction of up to ₹ 1.5 lakh for the premiums paid towards the plan under Section 80C2 of the Income Tax Act, 1961. So, you can save for your future needs as well as lower your taxes.

Importance of a retirement plan

Retirement planning helps you prepare for the future. Let’s better understand why you need a retirement plan.

Prepare for Medical Emergencies

Retirement plans provide you with regular income to help take care of your financial obligations once you retire. As you grow older, you may face certain health concerns or medical emergencies that require urgent care. The payouts can help you take care of hospital and medical bills, leaving you free to focus on your health instead of worrying about your finances.

Help Your Family

Your retirement plan enables you to support your family financially. The payouts allow you to maintain your independence and look after your finances. Depending on the corpus you grow, you can also help your loved ones with their various goals and dreams. Retirement plans also have a life insurance component and provide a payout to your beneficiary if something happens to you. The life cover ensures your loved ones do not have to struggle financially.

Remain Financially Independent

Nobody wishes to be dependent on others, especially not people who have worked hard for several years. Your retirement plan helps you maintain your financial independence once you retire. The payouts help you look after your bills and other financial obligations without relying on loved ones.

Meet Your Financial Goals

Retirement plans provide you with the regular payments you need to fulfil your financial goals. The amount helps you maintain your standard of living and protect your finances from inflation. Additionally, the amount helps you build an emergency fund and repay any pending debt.

Retirement Planning Stages

Your approach for retirement financial planning may differ at different stages of your life. Below is a breakdown of how you can plan your retirement through various life stages:

Young Adult (Age 21–35)

This is the time to establish a solid financial foundation. Starting your retirement planning early allows you to save more and earn higher returns. Your must focus on selecting suitable financial instruments that can help you get the benefit of compounding over time.

Early Midlife (Age 36–50)

During this life stage, your responsibilities towards your family may increase. However, it is also important to balance your current financial goals and your retirement needs. You may want to adjust your investment approach based on your evolving needs.

Later Midlife (Age 50–65)

As you approach retirement, it becomes essential to assess your financial readiness. You may want to fine-tune your investment portfolio to ensure that your retirement funds are adequate for your investment. It is also important to explore healthcare plans, as your medical expenses will likely increase as you age.

The Bottom Line

Everyone dreams of the day they can finally say goodbye to the workforce. But doing so costs money. That's where retirement planning comes into play.

It doesn't matter at what point you are in your life. Setting aside money now means you'll have less to worry about later.

FAQ's about Retirement Planning

You may have several dreams for your post-retirement life. With a little retirement planning in advance, you can fulfil your post-retirement goals while maintaining the same lifestyle.

With rising inflation, the cost of all products and services is increasing. With a sound retirement plan, you can ensure that your retirement funds are protected against inflation as well. It can also help you be ready for any unforeseen financial emergencies.

A retirement plan is designed to take care of your post-retirement days and help you lead a stress-free life. One such type is a retirement savings plan, which helps to grow your money and provide a regular income for life. Such plans help you set aside some amount towards your retirement while you are still working. The other type is a retirement annuity plan where you invest a one-time amount and receive a guaranteed1 regular income either immediately or at a later period from the purchase date.

Every retirement is unique. This is why, the money you need for your retirement depends on various factors like:

- Your retirement age

- Your health and lifestyle

- Any loans or liabilities

- The retirement goals you may have

- Any commitments you may have to fulfil

We can help you find out the amount you would require in a matter of seconds with our pension calculator. Just answer a few basic questions on your income, age, the number of years till you want to retire, and the premium amount you want to invest.

You can use our pension calculator to understand the ideal income you would require as per your needs.