NAV of HDFC Flexicap Fund

- Around 30 year back- Rs. 10

- Around 25 year back - Rs. 17

- Around 20 year back - Rs. 53

- Around 15 year back - Rs. 196

- Around 10 year back - Rs. 450

- Around 5 year back - Rs. 608

- Sept 2024 - Rs. 1883

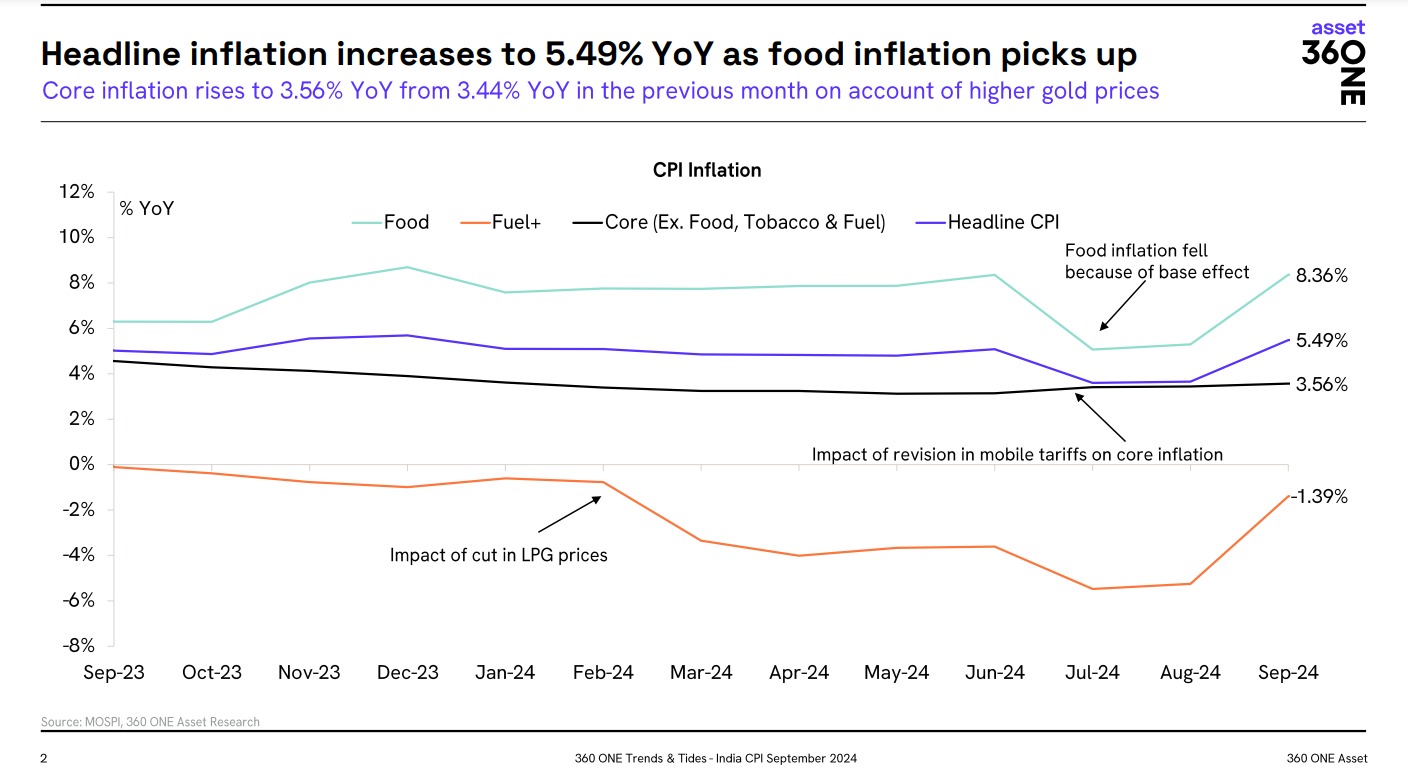

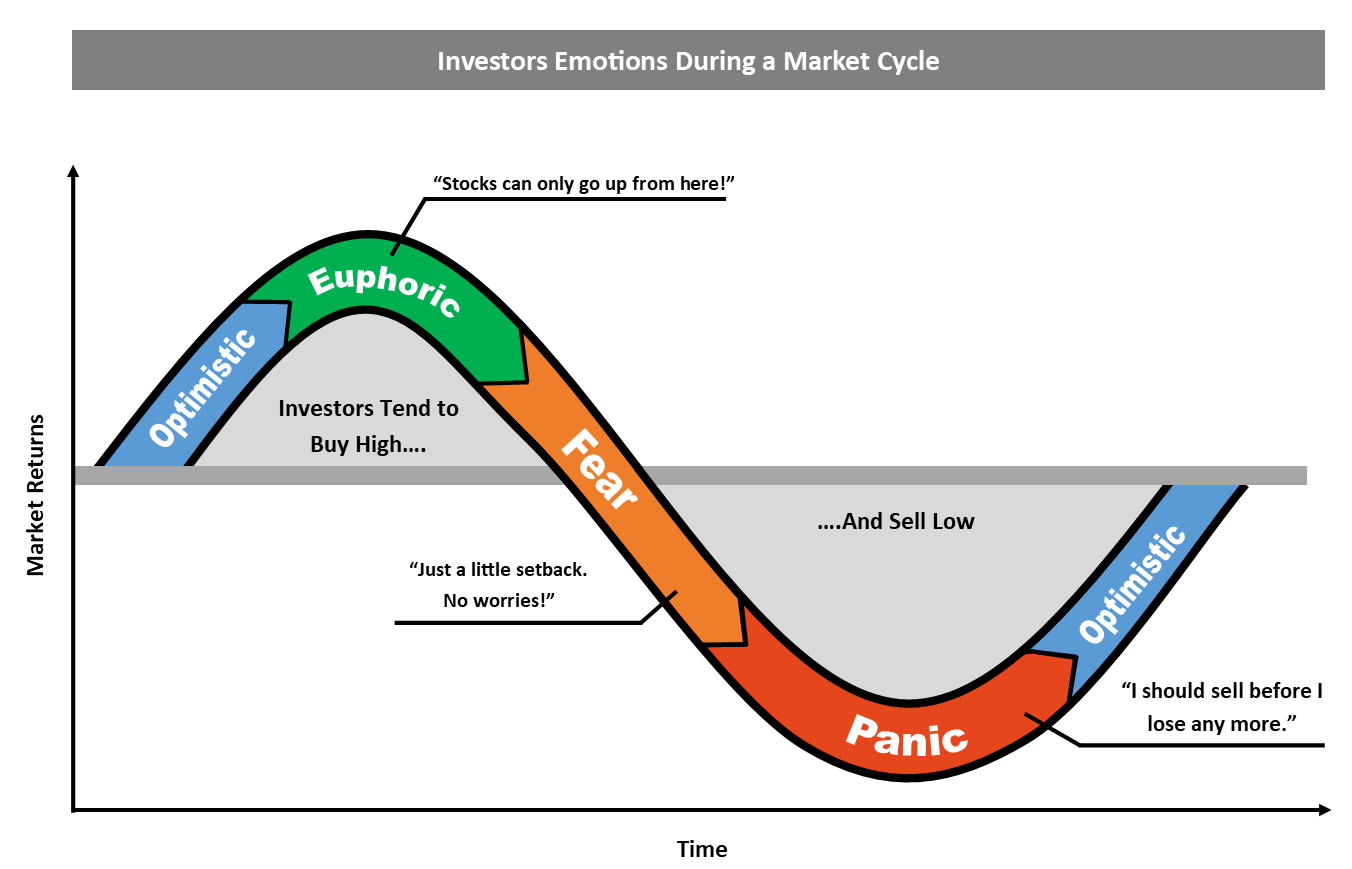

But this funds’ NAV has dropped

- 10% plus almost every 6 months.

- 20% plus almost every year.

- 30% plus almost every 4 years.

- 40% plus almost every 5 years.

- 50% drop almost every 8 years.

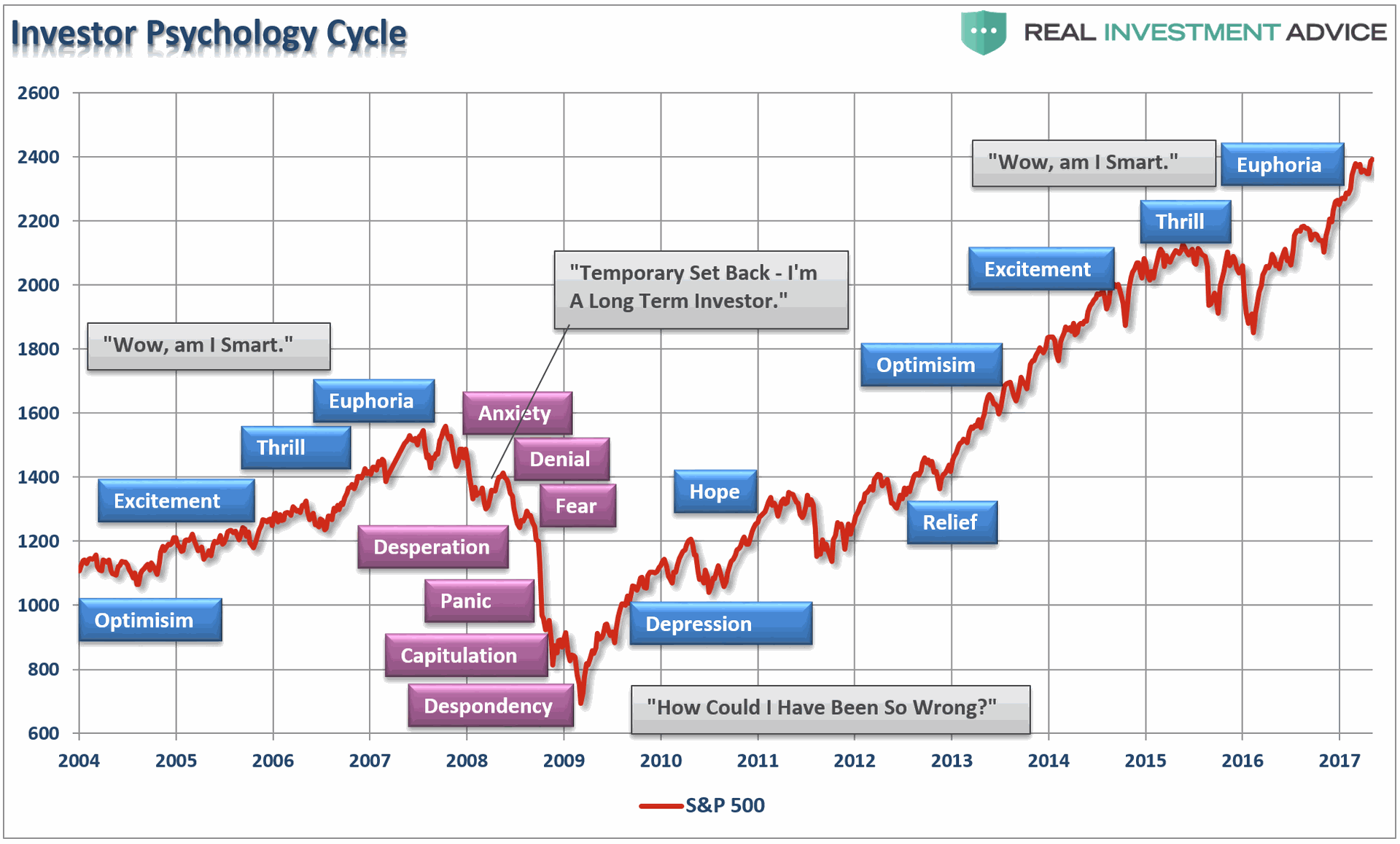

The above illustrations shows inevitability of market volatility in the pursuit of long-term wealth growth.

Despite significant drops in the Net Asset Value (NAV) of the HDFC Flexicap Fund over the years, it has still managed to grow substantially.

This aligns with the general philosophy that long-term investment success often involves weathering short-term market fluctuations.

The pattern described shows how resilient assets can recover and thrive after temporary downturns, underscoring the importance of patience and discipline in investing.

If you want your wealth to grow 10/20/30/50/100 times than you should be ready to accept 10-50% temporary drop as well.

There is no other way.

If Someone tells you that there is some other ways to grow wealth than he/she is either not aware or is lying.

Just like there is no other way to live a healthy/happy life except good diet/ physical activities/ meditation/happy family. All these things require attributes like patience/discipline/long term vision etc.

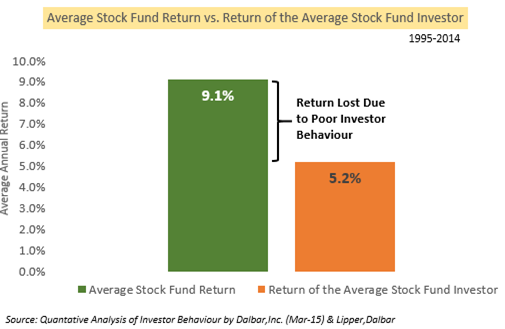

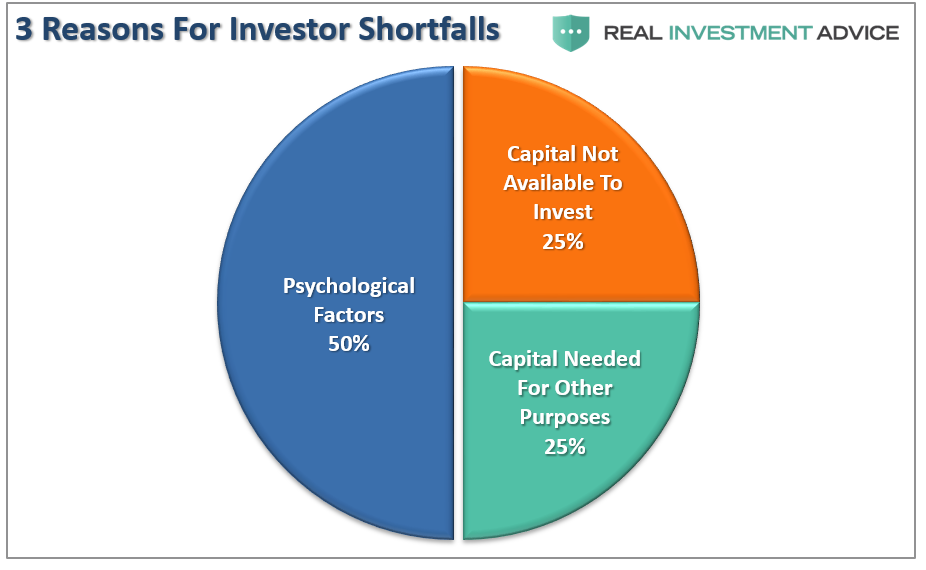

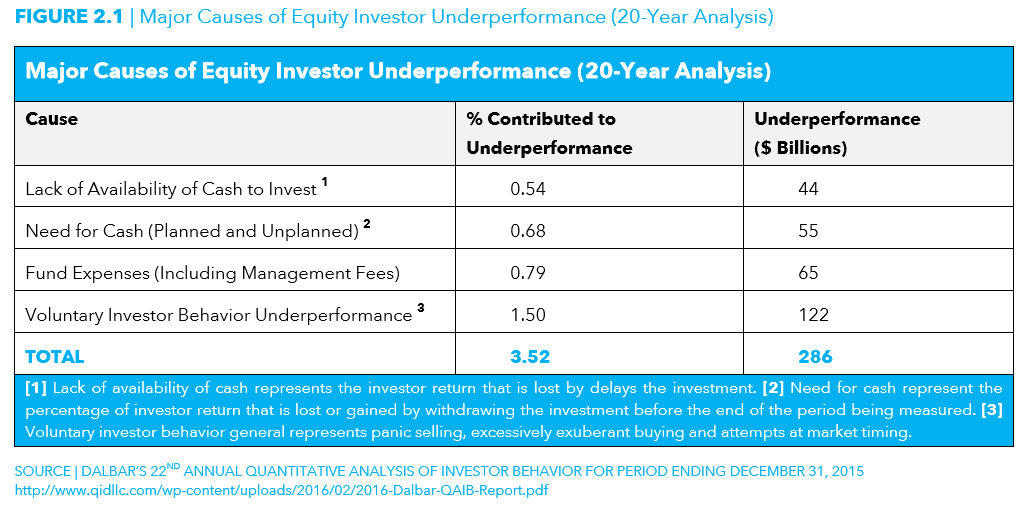

Research has consistently shown that behavior plays a more significant role in investment success than investment selection. Here are some key findings:

1. Dalbar Study (2020): Found that investor behavior accounted for 70% of investment returns, while investment selection accounted for only 30%.

2. Fidelity Investments Study (2019): Showed that investors who worked with a financial advisor achieved 4.7% higher returns than those who didn't, due to improved behavior.

3. Vanguard Study (2019): Found that advisor-guided portfolios outperformed self-managed portfolios by 3% annually, primarily due to behavioral differences.

4. Morningstar Study (2019): Revealed that investor returns trailed fund returns by 1.5% annually, largely due to behavioral mistakes.

5. Charles Schwab Study (2019): Found that investors who exhibited good behavioral traits (e.g., regular investing, diversification) achieved higher returns than those who didn't.

6. Harvard Business Review Study (2018): Showed that behavioral coaching improved investment outcomes by 22%.

Effective financial management plays a crucial role in reducing stress and anxiety in one's life. By creating a budget, building an emergency fund, and paying off debt, individuals can gain financial stability and security. This, in turn, enhances mental clarity, improves relationships, and increases overall well-being. A well-planned financial strategy allows individuals to feel in control, confident, and prepared for the future, ultimately reducing financial worries and stressors. By prioritizing financial health, individuals can break free from the cycle of financial stress and achieve a better quality of life.

Finance plays a significant role in reducing stress in an individual's life in several ways:

1. Financial Security: Having a stable income, savings, and investments provides peace of mind.

2. Debt Management: Paying off debts reduces financial burden.

3. Budgeting: Managing expenses helps prioritize needs over wants.

4. Emergency Fund: Having a cushion for unexpected expenses.

5. Long-term Planning: Retirement savings, insurance, and estate planning.

6. Financial Literacy: Understanding personal finance concepts.

7. Investment: Growing wealth through informed decisions.

8. Credit Score: Maintaining good credit for better loan terms.

9. Insurance: Protecting against unforeseen events.

10. Financial Goals: Achieving milestones, like homeownership.

To reduce financial stress:

1. Create a budget and track expenses.

2. Prioritize needs over wants.

3. Build an emergency fund.

4. Pay off high-interest debts.

5. Invest for the future.

6. Monitor credit reports.

7. Develop multiple income streams.

8. Educate yourself on personal finance.

9. Avoid impulse purchases.

10. Seek professional advice.

Financial wellness can significantly reduce stress, leading to:

- Improved mental health

- Better relationships

- Increased productivity

- Enhanced overall well-being

Resources:

- National Foundation for Credit Counseling (NFCC)

- Financial Counseling Association of America (FCAA)

- National Association of Personal Financial Advisors (NAPFA)

- Financial Planning Association (FPA)

Jewellery, cash, and crucial documents worth Rs 2.78 crore were looted from a locker at Punjab National Bank’s Cantonment branch, with the bank manager reportedly involved in the crime. The embezzlement, which occurred between August 13, 2023 and September 6, 2024, took place at Aurora Towers in the Cantonment area.

Read more

Several significant changes to your income taxes will take effect on October 1. In the Union Budget 2024, there were few changes made to Aadhaar card, STT, TDS rate, Direct Tax Vivad Se Vishwas Scheme 2024. The proposed changes were passed in the Finance Bill.

Here is a look at important tax changes that will come into effect from October 1, 2024.

1. STT

The 2024 budget has increased the securities transaction tax (STT) on Futures & Options (F&O) of securities to 0.02 percent and 0.1 percent respectively and income receipts from share buybacks would be taxed in the hands of beneficiaries.

This amendment is passed and to be made effective from October 1, 2024.

2. Aadhaar

In order to prevent PAN misuse and duplication, effective October 1, the provisions that permit citing an Aadhaar Enrollment ID in lieu of an Aadhaar number, Aadhaar in ITRs, and PAN applications will no longer be applicable.

Aadhaar enrollment ID won't be accepted in lieu of Aadhaar in ITR, PAN application from this date to plug PAN misuse, duplication

3. Buy-back of shares

As of October 1, buyback of shares will be subject to shareholder-level taxes, much like dividends. This will result in a higher tax burden for investors. Additionally, the shareholder's acquisition costs of these shares will be taken into account when calculating any capital gains or losses.

4. Floating rate bonds TDS

In Budget 2024, it was announced that starting from October 1, 2024, tax deducted at source (TDS) will be deducted at a 10% rate from specified central and state government bonds, including floating rate bonds.

There is a Rs 10,000 threshold limit, after which the tax is deducted. This means that there is no TDS if the revenue earned throughout the year is less than Rs 10,000.

Budget 2024 proposed 10% TDS on government bonds: You can still pay lower or zero TDS with this certificate

5. TDS rates

The TDS rates proposed in the Union Budget 2024 were approved in the Finance Bill:

The TDS rate for payments under sections 19DA, 194H, 194-IB, and 194M was reduced from 5% to 2%. TDS rate reduction for e-commerce operators: The TDS rate for e-commerce operators was reduced from 1% to 0.1%.

• Section 194DA - Payment in respect of life insurance policy

• Section 194G -Commission on sale of lottery tickets

• Section 194H - Payment of commission or brokerage

• Section 194-IB - Payment of Rent by certain individuals or HUF

• Section 194M - Payment of certain sums by certain individuals or HUFs

• Section 194F - Payment on account of repurchase of units by mutual funds or UTI is proposed to be omitted from October 1, 2024.

6. Direct Tax Vivad Se Vishwas Scheme 2024

The Central Board of Direct Taxes (CBDT) has announced the Direct Tax Vivad Se Vishwas Scheme, 2024 (also known as DTVSV, 2024) to settle outstanding appeals in cases of income tax disputes. Starting on October 1, 2024, the aforementioned Scheme will be implemented.

The DTVSV Scheme provides for lesser settlement amounts for a ‘new appellant’ in comparison to an ‘old appellant’. The DTVSV Scheme also provides for lesser settlement amounts for taxpayers who file declaration on or before December 31, 2024 in comparison to those who file thereafter

India’s forex reserves have crossed a whopping $700 billion. This feat is amazing because we’re only the fourth country to hit this mark.

This calls for a celebration, no?

Website may use cookies to personalize and facilitate maximum navigation of the User by this site. The User may configure his / her browser to notify and reject the installation of the cookies sent by us.

These terms of service ("Terms", "Agreement") are an agreement between the website ("Website operator", "us", "we" or "our") and you ("User", "you" or "your"). This Agreement sets forth the general terms and conditions of your use of this website and any of its products or services (collectively, "Website" or "Services").

1. Bulls – Optimistic investors who believe the market will rise.

2. Bears – Pessimistic investors expecting a market decline.

3. Rabbits – Traders who hold positions for a very short time.

4. Turtles – Long-term investors who trade slowly and focus on long-term gains.

5. Pigs – Greedy and impatient traders who take high risks and often lose.

6. Ostriches – Investors who ignore negative market news, hoping their investments survive.

7. Chickens – Fearful investors who avoid risk and stick to safe investments.

8. Sheep – Investors who follow the majority without independent strategy.

9. Dogs – Stocks beaten down by the market but expected to recover.

10. Stags – Opportunistic traders who look for quick gains, especially from IPOs.

11. Wolves – Traders who use unethical methods to manipulate the market for profit.

Bonus:

Whales – Big investors who can move markets.

Sharks – Traders focused solely on making quick profits.

Dead Cat -Bounce – A temporary recovery during a downtrend.

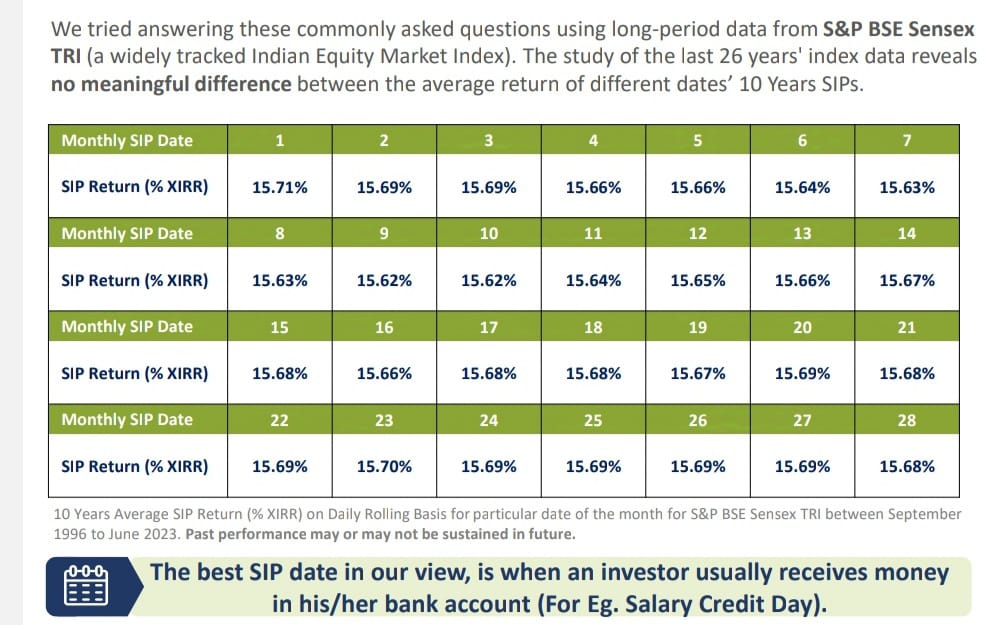

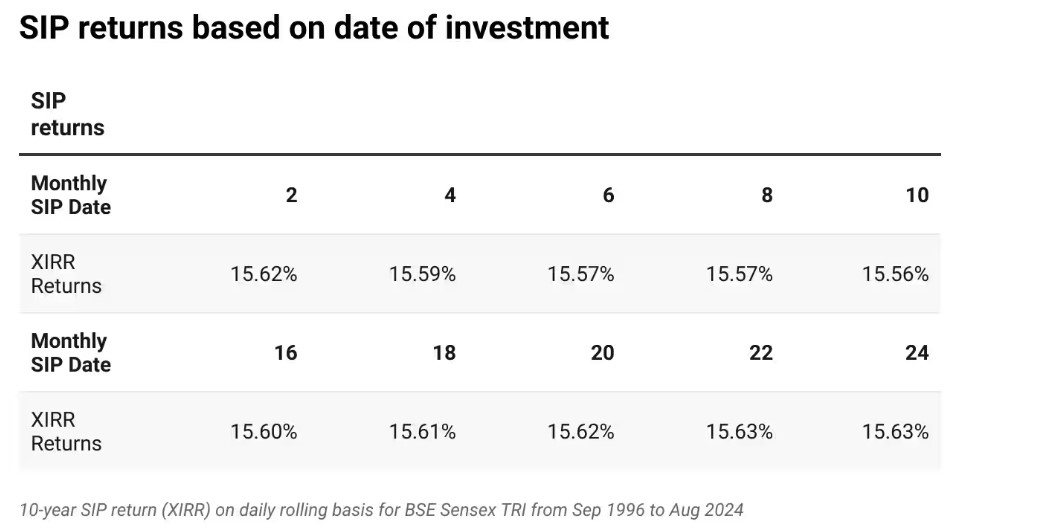

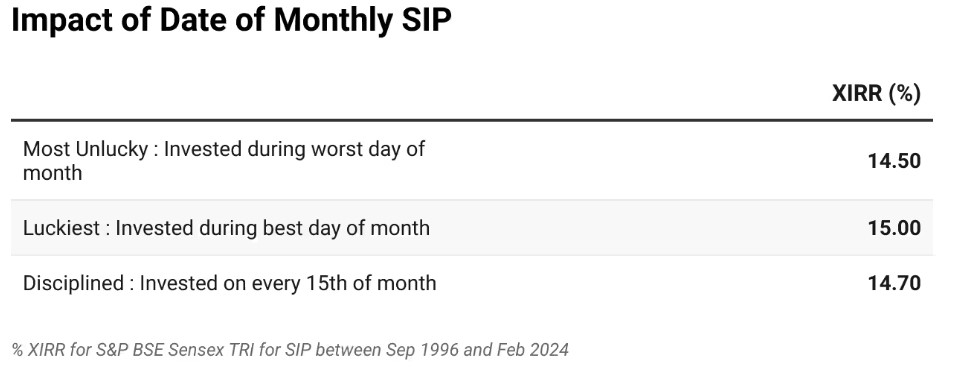

Also, it does not really matter which day or date you invest on, as returns tend to converge over an extended period.

SIPs should be for the long term.

Systematic investment plans (SIPs) have been an instrument of choice for retail investors, allowing them to not try and time the market, but instead invest regularly in a disciplined manner per their income and objectives.

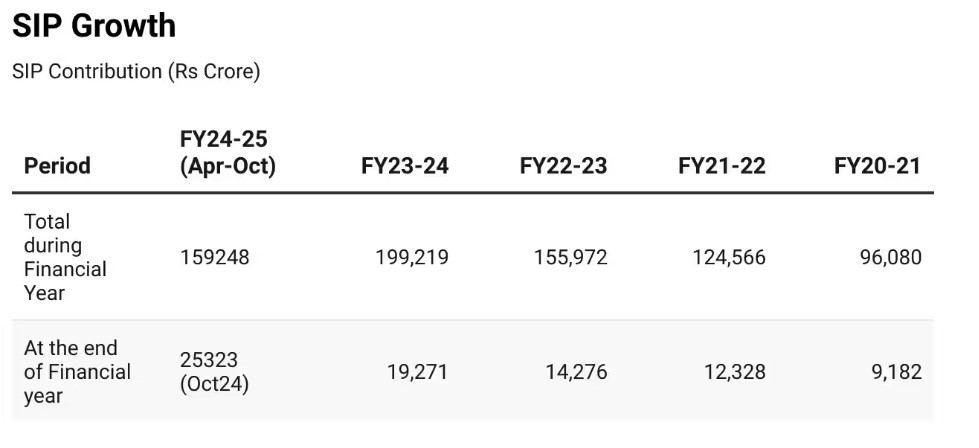

Accordingly, SIP inflows have grown tremendously. AMFI (Association of Mutual Funds of India) data (table 1) shows that gross SIP inflows in October 2024 touched a record Rs 25,323 crore, from Rs 20,000 crore at the start of this fiscal year. Indeed, YTD (year-to-date) inflows (April-October '24) have already topped full-year SIP flows of FY 2022-23.

To an extent, rising SIP flows have been able to cushion the volatility due to several high-impact events across the globe (and India). Large FII outflows in recent months have not had as severe an impact as they would have if SIPs did not compensate. Indeed, the volatility in this phase has worked to the advantage of SIP investors, as they accumulated additional units at lower valuations, boosting long-term returns.

Long-term SIP investors

We say that SIPs should be for the long term, so we wanted to check what counts as long-term for there to be a favourable outcome. Caveat: past returns may not be sustained in the future.

As the data indicates (table 2), a SIP investment horizon of three years is likely to yield positive returns. If the tenor is increased to five years, the odds shift significantly in favour of positive returns. By increasing the tenor to 10 and 15 years, the chances of getting superior returns continue to increase.

This tells long-term SIP players that they need to be resilient and continue to invest through different market cycles in diversified categories or indices. Top-up SIPs would have an even higher impact (as your income increases over time), which would help build an investment portfolio aligned to your goals.

SIP frequency

An investor is often confronted with the question as to what should be the ideal SIP frequency (daily, weekly, monthly), and which day / date/s of the month should one invest on for maximum returns.

Our analysis shows that the day / date of investment doesn't really matter as returns over an extended period (10-year daily rolling returns, in the example below) tend to converge.

Another study on the frequency of SIPs had also indicated that over a long period of time, it does not really matter which date you invest on.

So, obsessing too much over this does not lead to higher returns.

Conclusion

In sum, the question is whether SIPs make money across phases in the long term.

Studies suggest that the probability of reasonable returns increases significantly as the SIP time horizon increases. Ergo, one should start SIPs in a diversified or index fund, be disciplined, and stick to the same, with top-ups as one's income increases, to build a sizeable corpus aligned to one's long-term goals.

Disclaimer: The information provided on JAYY FINVISORS is for general information purposes only and should not be considered as investment, tax, or financial advice. JAYY FINVISORS advises users to check with certified experts before taking any investment decisions.

Investing in mutual funds has become a popular choice for many Indians due to its potential returns and convenience. However, it’s easy to make mistakes that could hinder your investment success. Here’s a rundown of common mutual fund pitfalls to watch out for and how to avoid them.

1. Skipping Financial Planning

Mistake: Diving into mutual funds without a clear financial plan often leads to mismatched investments that don’t suit an individual’s risk tolerance or financial needs. Many investors choose funds at random, only to abandon them when market volatility strikes.

Solution: A solid financial plan is essential. Evaluate your financial goals, risk appetite, and ensure you have an emergency fund in place before investing. Seek professional advice to align your portfolio with your needs.

2. Relying on Past Performance

Mistake: Many investors base decisions solely on a fund’s past returns, assuming it will continue to perform the same. This often results in buying into funds that may not be suited for current or future conditions.

Solution: Instead of focusing solely on past performance, assess the fund’s stability, risk level, and the experience of its fund manager. This approach gives a more holistic view of the fund’s potential.

3. Over-Diversifying

Mistake: While spreading investments can reduce risk, over-diversifying leads to overlapping portfolios, often with similar stocks across multiple funds, which increases costs and complicates monitoring.

Solution: Aim for a balanced portfolio with a select few well-chosen funds that align with your goals, avoiding unnecessary duplication.

4. Ignoring Expense Ratios

Mistake: Overlooking the expense ratio can be costly, as it affects net returns. Direct fund options tend to have lower expense ratios than regular funds, which include distribution fees.

Solution: Compare expense ratios within fund categories, and consider opting for direct plans or index funds to keep fees low.

5. Underestimating Index Funds

Mistake: Many investors overlook index funds, even though a large portion of actively managed funds often underperform their benchmarks.

Solution: Evaluate if actively managed funds are consistently outperforming benchmarks. If not, switching to lower-fee index funds could provide better long-term returns.

6. Jumping into New Fund Offers (NFOs)

Mistake: NFOs often attract investors due to their low starting price, but unlike IPOs, they lack a performance track record, and the portfolio structure is unclear at launch.

Solution: Only consider NFOs that offer something unique or innovative in terms of strategy. Avoid NFOs that replicate existing funds unless they offer a clear advantage.

7. Reacting Impulsively to Market Fluctuations

Mistake: Market downturns can trigger panic selling, resulting in losses for investors who don’t stay focused on long-term goals.

Solution: Understand the risks and remain committed to your investment plan. Choose funds with a solid foundation and avoid reacting to short-term market volatility.

8. Overlooking Tax Consequences

Mistake: Different mutual fund categories have varied tax treatments, which can significantly impact net returns.

Solution: Know the tax implications of each fund type. Equity funds held over a year, for example, have different tax rules than those sold within a year. Consult a financial advisor for specific guidance.

9. Avoiding SIPs

Mistake: Many investors prefer lump-sum investments, which may expose them to timing risks.

Solution: Systematic Investment Plans (SIPs) allow for regular investments regardless of market conditions, helping to average out costs over time and instilling discipline.

10. Skipping Portfolio Reviews

Mistake: Not revisiting the portfolio can lead to holding onto underperforming funds.

Solution: Review your portfolio at least annually to evaluate performance and make necessary adjustments.

11. Getting Swayed by Market Hype

Mistake: Media and market hype can cause rushed decisions. Funds in the news for high returns may not sustain those returns.

Solution: Focus on research and consult reliable financial advice rather than following market noise.

12. Skipping Professional Guidance

Mistake: Believing mutual funds are simple, some investors skip consulting advisors, leading to uninformed choices.

Solution: For beginners, professional advice can help tailor investments to your financial goals and risk profile.

13. Ignoring Fund Types and Their Impact

Understanding the specific type of mutual fund is crucial, as each fund category has its own risk and return profile.

Solution: Familiarize yourself with the fund types:

- Equity Funds: Primarily stock-based, higher risk and return.

- Debt Funds: Fixed-income instruments with lower volatility, suited for conservative investors.

- Hybrid Funds: Mixed portfolios balancing risk and return.

14. Ignoring Exit Load Fees

Mistake: Exit loads, or fees for early withdrawals, can add unnecessary costs if not checked.

Solution: Review a fund’s exit load policy. If you may need quick access to your funds, look for funds with minimal exit fees.

15. Investing Based on Others’ Choices

Mistake: Just because a friend or family member invests in a particular fund doesn’t mean it’s the right fit for you.

Solution: Make investment decisions based on your financial situation, goals, and risk tolerance—not someone else’s.

Final Thoughts

Mutual funds can be an effective way to grow wealth, but they come with challenges. By avoiding these common mistakes, you can set yourself up for success.

Smart investing isn’t only about seizing opportunities; it’s also about minimizing potential missteps.

With patience, discipline, and knowledge, mutual funds can be a valuable addition to your financial portfolio.